factoring - invoice financing

Immediately cash 90% of the amount of your invoices.

Don't wait to get paid. Discover ultra-simplified and transparent factoring for the construction industry with Faktus.

factoring

factoring

factoring

Immediately cash 90% of the amount of your invoices.

Immediately cash 90% of the amount of your invoices.

Immediately cash 90% of the amount of your invoices.

Don't wait to get paid. Discover ultra-simplified factoring with Faktus.

Don't wait to get paid. Discover ultra-simplified factoring with Faktus.

Don't wait to get paid. Discover ultra-simplified factoring with Faktus.

Your invoice has been financed!

How does it work?

How does it work?

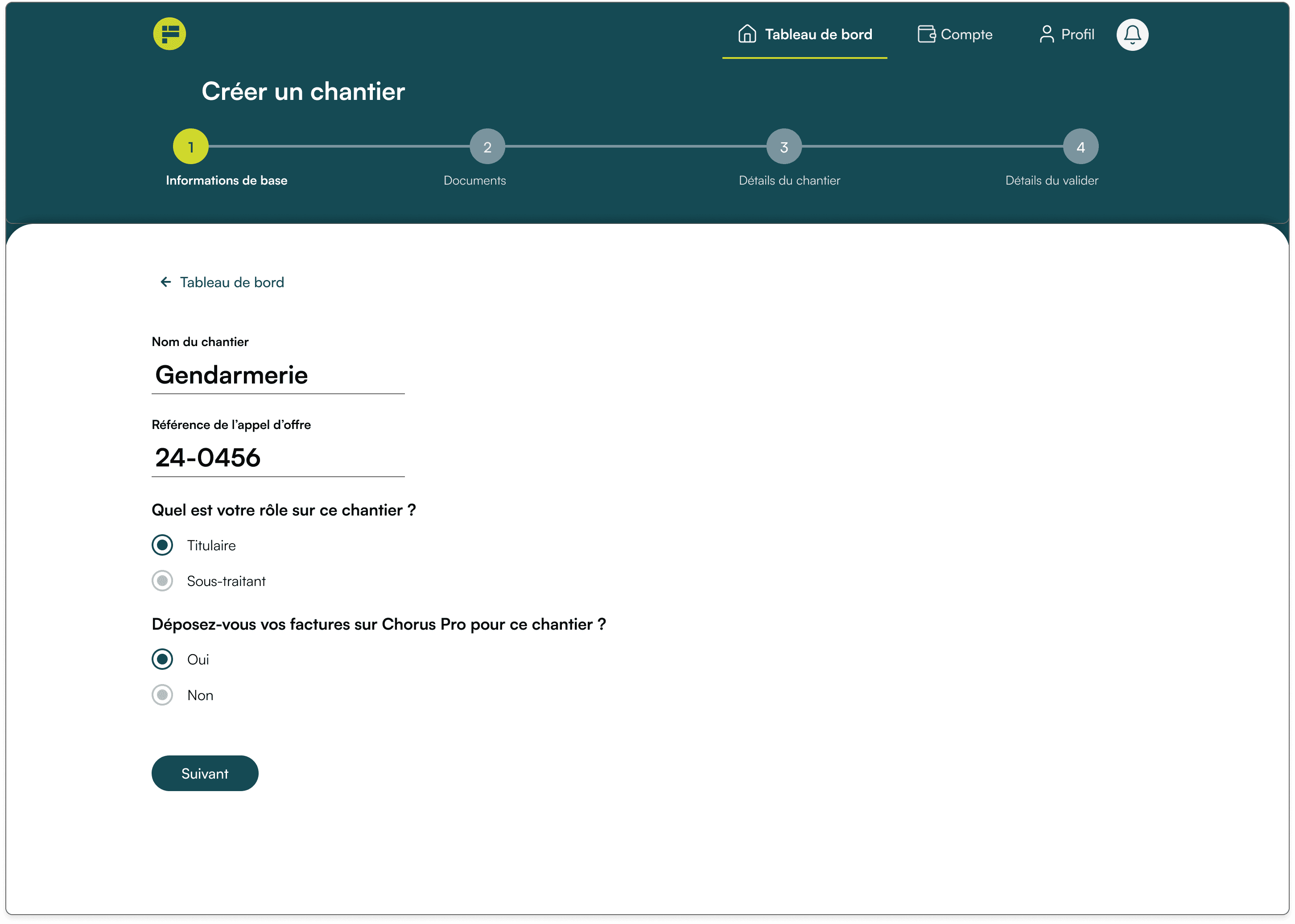

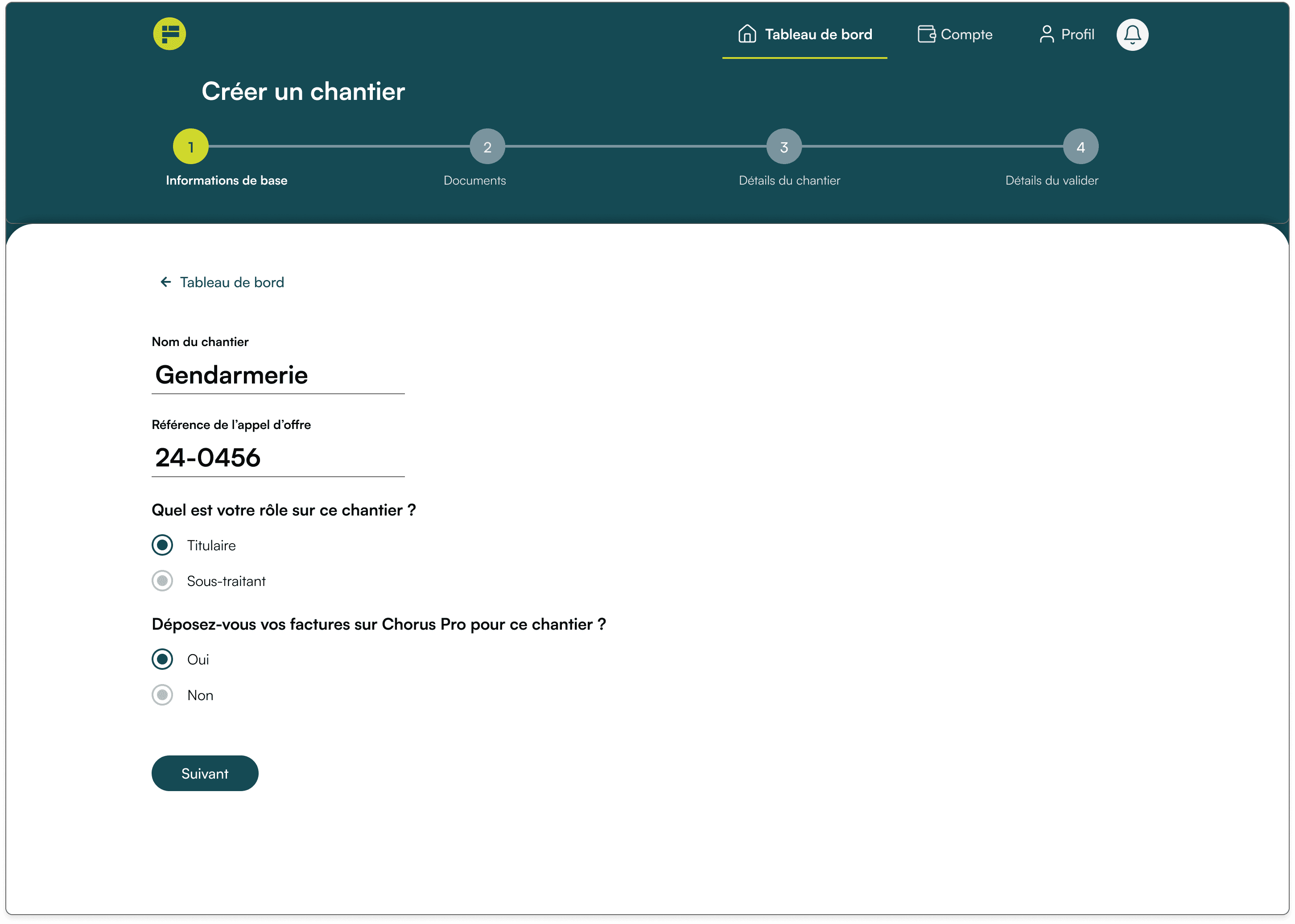

01

01

Create your site

Create your site

02

02

Submit your progress invoice

Submit your progress invoice

03

03

Receive 90% of your invoice amount in your account within 2 hours

Receive 90% of your invoice amount in your account within 2 hours

04

04

Refund your financing at the time of cashing in

Refund your financing at the time of cashing in

Why try special construction factoring with Faktus?

Why try special construction factoring with Faktus?

Why try special construction factoring with Faktus?

At Faktus, we understand that managing payment deadlines can become a real headache for businesses. Unpaid invoices, particularly in sectors such as construction, retail or services, often tie up a significant portion of cash flow, thereby slowing down your projects. That’s why we have developed a fast, efficient and transparent invoice financing solution tailored to the needs of micro-enterprises, small and medium-sized enterprises, and large companies.

Invoice financing, also known as factoring, allows you to convert your customer receivables into immediately available liquidity, without waiting for the sometimes long payment deadlines imposed by your project managers. Specifically, as soon as one of your invoices is issued and validated by your project manager, Faktus pays you immediately up to 90% of its amount. Once the payment is received from your project manager, the remaining balance, minus management fees, is returned to you.

This factoring service for construction businesses offers multiple benefits:

Improvement of your cash flow: You quickly access the funds needed to cover your current expenses, pay your suppliers and collaborators, or invest in new projects.

Reduction of bad debt risks: Faktus monitors the payment of your invoices, providing you with peace of mind and professional tracking. No invoice will be forgotten.

Administrative time savings: You can focus on developing your business without being hindered by tasks related to payment management.

Our experts support you at every step to tailor the solution to your needs. With Faktus, you choose simplified cash management, a clear process, and immediate results. Don't let payment delays in construction hold back your growth. Try Faktus and give your business the momentum it deserves.

At Faktus, we understand that managing payment deadlines can become a real headache for businesses. Unpaid invoices, particularly in sectors such as construction, retail or services, often tie up a significant portion of cash flow, thereby slowing down your projects. That’s why we have developed a fast, efficient and transparent invoice financing solution tailored to the needs of micro-enterprises, small and medium-sized enterprises, and large companies.

Invoice financing, also known as factoring, allows you to convert your customer receivables into immediately available liquidity, without waiting for the sometimes long payment deadlines imposed by your project managers. Specifically, as soon as one of your invoices is issued and validated by your project manager, Faktus pays you immediately up to 90% of its amount. Once the payment is received from your project manager, the remaining balance, minus management fees, is returned to you.

This factoring service for construction businesses offers multiple benefits:

Improvement of your cash flow: You quickly access the funds needed to cover your current expenses, pay your suppliers and collaborators, or invest in new projects.

Reduction of bad debt risks: Faktus monitors the payment of your invoices, providing you with peace of mind and professional tracking. No invoice will be forgotten.

Administrative time savings: You can focus on developing your business without being hindered by tasks related to payment management.

Our experts support you at every step to tailor the solution to your needs. With Faktus, you choose simplified cash management, a clear process, and immediate results. Don't let payment delays in construction hold back your growth. Try Faktus and give your business the momentum it deserves.

At Faktus, we understand that managing payment deadlines can become a real headache for businesses. Unpaid invoices, particularly in sectors such as construction, retail or services, often tie up a significant portion of cash flow, thereby slowing down your projects. That’s why we have developed a fast, efficient and transparent invoice financing solution tailored to the needs of micro-enterprises, small and medium-sized enterprises, and large companies.

Invoice financing, also known as factoring, allows you to convert your customer receivables into immediately available liquidity, without waiting for the sometimes long payment deadlines imposed by your project managers. Specifically, as soon as one of your invoices is issued and validated by your project manager, Faktus pays you immediately up to 90% of its amount. Once the payment is received from your project manager, the remaining balance, minus management fees, is returned to you.

This factoring service for construction businesses offers multiple benefits:

Improvement of your cash flow: You quickly access the funds needed to cover your current expenses, pay your suppliers and collaborators, or invest in new projects.

Reduction of bad debt risks: Faktus monitors the payment of your invoices, providing you with peace of mind and professional tracking. No invoice will be forgotten.

Administrative time savings: You can focus on developing your business without being hindered by tasks related to payment management.

Our experts support you at every step to tailor the solution to your needs. With Faktus, you choose simplified cash management, a clear process, and immediate results. Don't let payment delays in construction hold back your growth. Try Faktus and give your business the momentum it deserves.

A solution for every need, site by site

A solution for every need, site by site

A solution for every need, site by site

Business account

No need to advance money for your projects, create your Faktus account to maintain a consistently positive cash flow.

Learn more

Surety

Request a Surety deposit at the start of the work and collect 100% of the amount of your invoices.

Learn more

Material advance

No deposit? Get an advance at the start of the project and pay your suppliers without going into the red.

Learn more

Material advance

No deposit? Get an advance at the start of the project and pay your suppliers without going into the red.

Learn more

Business account

No need to advance money for your projects, create your Faktus account to maintain a consistently positive cash flow.

Learn more

Retention of Guarantee

Request a Retention Guarantee deposit at the start of the work and collect 100% of the amount of your invoices.

Learn more

Material advance

No deposit? Get an advance at the start of the project and pay your suppliers without going into the red.

Learn more

Business account

No need to advance money for your projects, create your Faktus account to maintain a consistently positive cash flow.

Learn more

Retention of Guarantee

Request a Retention Guarantee deposit at the start of the work and collect 100% of the amount of your invoices.

Learn more

FAQ

FAQ

FAQ

What is factoring?

Why is factoring particularly interesting in the construction industry?

How can we ensure that the invoices are properly transmitted?

How does an factoring contract work?

What are the fees associated with factoring?

Can we invoice progress bills?

Can I choose the invoices that I want to transfer?

What is factoring?

Why is factoring particularly interesting in the construction industry?

How can we ensure that the invoices are properly transmitted?

How does an factoring contract work?

What are the fees associated with factoring?

Can we invoice progress bills?

Can I choose the invoices that I want to transfer?

What is factoring?

Why is factoring particularly interesting in the construction industry?

How can we ensure that the invoices are properly transmitted?

How does an factoring contract work?

What are the fees associated with factoring?

Can we invoice progress bills?

Can I choose the invoices that I want to transfer?

Contact us for more information

Contact us for more information

Contact us for more information

Faktus, a company registered with the Paris Trade and Companies Register under number 978 087 138, whose registered office is located at 142 Rue Montmartre 75002 Paris, is listed in the Unique Register of Insurance, Banking and Financial Intermediaries under registration number 23008083 as a non-exclusive agent in banking operations and payment services.

© 2026 Faktus

Faktus, a company registered with the Paris Trade and Companies Register under number 978 087 138, whose registered office is located at 142 Rue Montmartre 75002 Paris, is listed in the Unique Register of Insurance, Banking and Financial Intermediaries under registration number 23008083 as a non-exclusive agent in banking operations and payment services.

© 2026 Faktus

Faktus, a company registered with the Paris Trade and Companies Register under number 978 087 138, whose registered office is located at 142 Rue Montmartre 75002 Paris, is listed in the Unique Register of Insurance, Banking and Financial Intermediaries under registration number 23008083 as a non-exclusive agent in banking operations and payment services.

© 2026 Faktus